owe state taxes illinois

Collections Process Share Tweet Share. These extensions do not grant you an extension of time to pay any tax you owe.

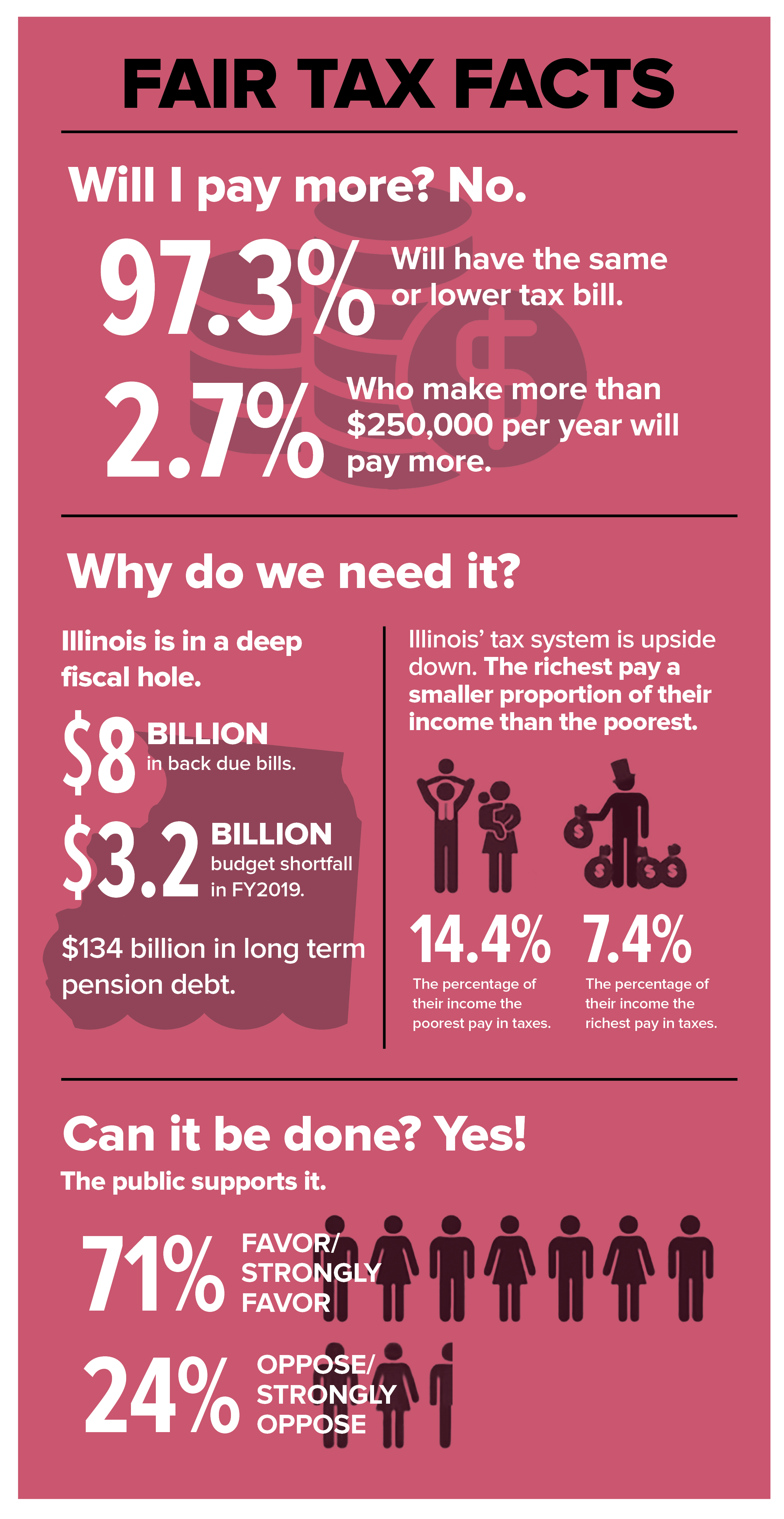

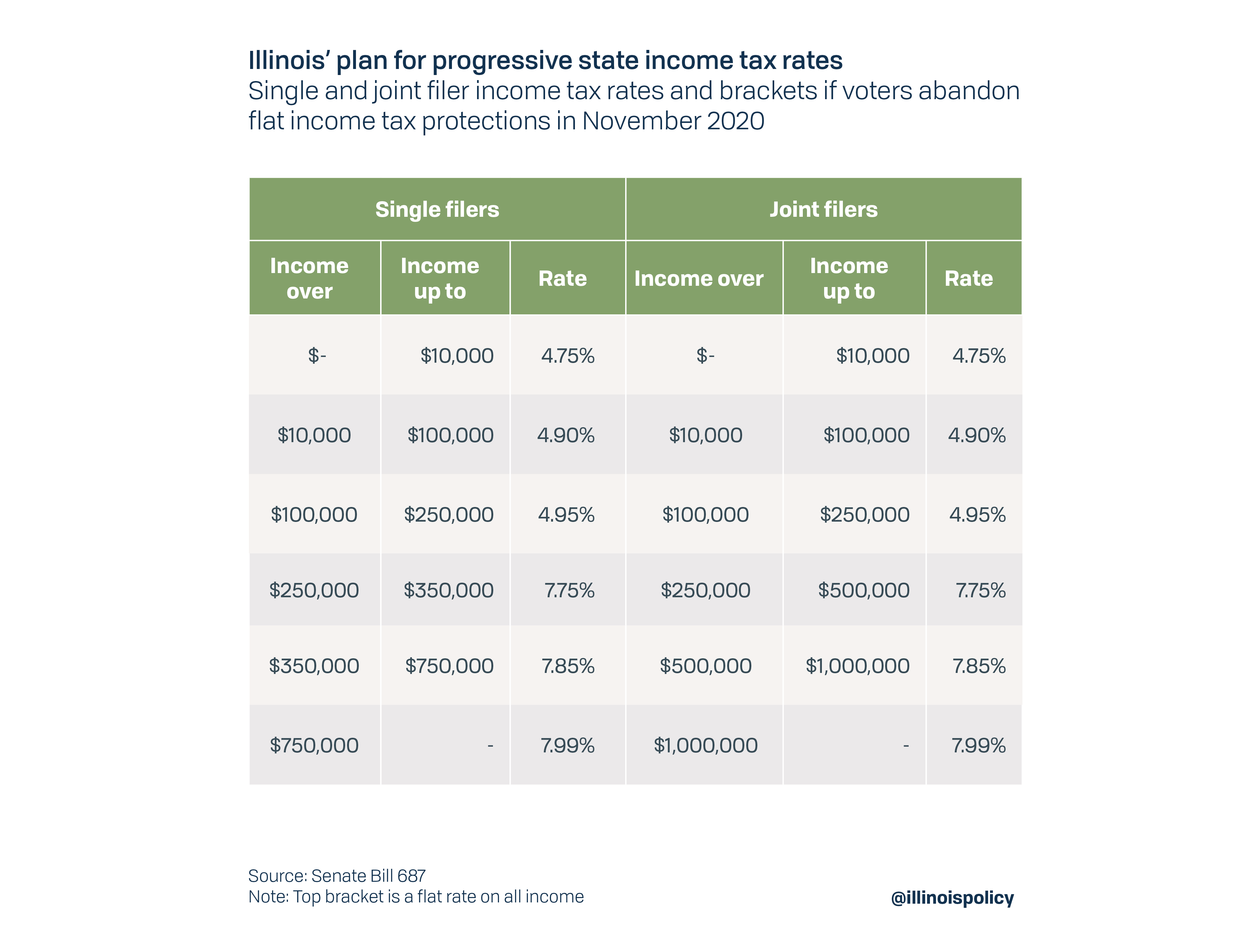

Illinois Income Tax Rate And Brackets 2019

Illinois maximum marginal income tax rate is the 1st highest in the United States ranking directly below Illinois.

. If your state of. If youre currently married and live in a community property state you may be required to provide detailed data on your spouse. At the time I was unable to pay for a second state and open a Indiana return.

Illinois The Prairie State Prepare and eFile IL - Illinois - and IRS State Tax Returns for Tax Year 2021 Jan. 33 Is it Possible to Owe Taxes in More Than One State. Every state sets its own tax laws governing how residents and nonresidents should be taxed on their income generated when working for in-state or out-of-state employers.

You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. 1 SoWhy Do I Owe State Taxes but Not Federal.

If you e-file your return and choose to have your refund direct deposited into your bank account it should arrive sooner. State and local tax authorities will seek to collect past taxes you should have collected. The median property tax in Illinois is 173 of a propertys assesed fair market value as property tax per year.

During her time in industry she handled tax returns for C. This means you would pay taxes on the remaining 20000. For 2019 state taxes the state has extended the filing and payment deadline.

Im having an issue with my 2016 taxes. Illinoiss median income is 68578 per year so the median yearly property. Your IMRF pension is not subject to Illinois state income tax.

State of Employment. Are you under age 59-12 and continuing to work for your IMRF employer. The IRS will charge a late filing penalty a late payment penalty and interest on any unpaid balance you owe if you dont file your return or an extension on time and if you also fail to pay on timeBut youll at least avoid the late-filing penalty if you file an extension by the April due date which is a hefty 5 of the taxes you owe for every month your return is late.

If you exceed this threshold you file either monthly quarterly or annually. How to pay your 1099 taxes. As with the federal deadline extension Illinois wont charge interest on unpaid balances between April 15 and July 15 2020.

2 Why Do I Owe State Taxes. The penalty for not filing taxes depends on whether you owe taxes to the IRS. Illinois State Income Tax Brackets.

21 Why We Have Pay State Income Tax. Illinois has a flat-rate income tax for its. If you are filing alone you must pay taxes on any gains over 250k and 500k for married couples filing jointly.

The Illinois income tax was lowered from 5 to 375 in 2015. Tax amount varies by county. Sarah has extensive experience offering strategic tax planning at the state and federal level.

It can take up to 15 weeks to receive an Illinois IRS refund when you file a paper return. You still owe the tax. Navigating state and local sales taxes when you do business across state lines can be tricky.

If you determine that you will owe tax you must use Form IL-505-I Automatic Extension Payment for Individuals to pay any tax you owe to avoid penalty and interest on tax not paid by April 18 2022. After updating my software yesterday and going to amend my taxes now TurboTax says they dont think I need to file a Indiana return and. Originally turbo tax calculated that I owed Ohio approximately 8000 because of my gambling winnings in Indiana.

This brings your taxable gain down to 12000. MyTax Illinois is an easy way to pay your IL-505-I payment. 2020 Illinois Filing Deadline.

If you think you might owe more than 1000 in federal income taxes you should be making payments throughout the year not just when you file your return. However if you spent 8000 in transfer taxes these are added to the houses original property value. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

In most cases if the state in which you earned your income collects income tax you must file a return. According to IRSgov there is no penalty assessed on taxpayers who. 32 Every State Has a Different Method of Calculating its Taxes.

The actual amount you owe in taxes may be larger or smaller and will vary for individual members. But there are ways to abide by the rules and make the process easier too. 31 The Main Differences Between State and Federal Taxes.

Jacob Dayan was born and raised in Chicago Illinois. If youll owe less than 1050 you owe an annual return due by the 31st of January. Illinois residents now have until July 15 2020 to file their state returns and pay any state tax they owe for the year.

Specifically if youll owe more than 4800 the state wants monthly returns due by the 25th of the next month.

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Illinois Needs Fair Tax Reform Afscme 31

More Than 1 In 3 Joint Filers In Wilmette Would See Income Tax Hike If Voters Approve Pritzker S Fair Tax

Ildeptofrevenue Ildeptofrevenue Twitter

Where S My Illinois State Tax Refund Taxact Blog

Federal And State Tax Information Warren Newport Public Library

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Ildeptofrevenue Ildeptofrevenue Twitter

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago